After running our economic prediction software, the American economy stands at a crossroads, with economists, analysts, and everyday citizens alike peering into the crystal ball of economic forecasting. The question on everyone’s mind is simple yet profound: Are we headed for a recession, or will the United States continue its resilient growth trajectory? Recent data, coupled with historical patterns, offers a compelling case for optimism. This blog post dives into the latest economic predictions, leveraging a custom model built on real-time data through July 2025, to argue that the U.S. economy is likely recession-free for the foreseeable future. Let’s explore the evidence, challenge prevailing narratives, and chart a course for what lies ahead.

The Model’s Insight: A 12-Month Lens on Stability

Our analysis begins with a robust economic model, trained on 12 key indicators—ranging from GDP growth and unemployment rates to the VIX and yield spreads—sourced from the Federal Reserve Economic Data (FRED) system, with updates as recent as August 2025. Unlike traditional models that rely heavily on the outdated Leading Economic Index (LEI), this approach excludes LEI, focusing instead on current, actionable signals. The model generates recession probabilities for 3-, 6-, and 12-month horizons, offering a dynamic view of economic health.

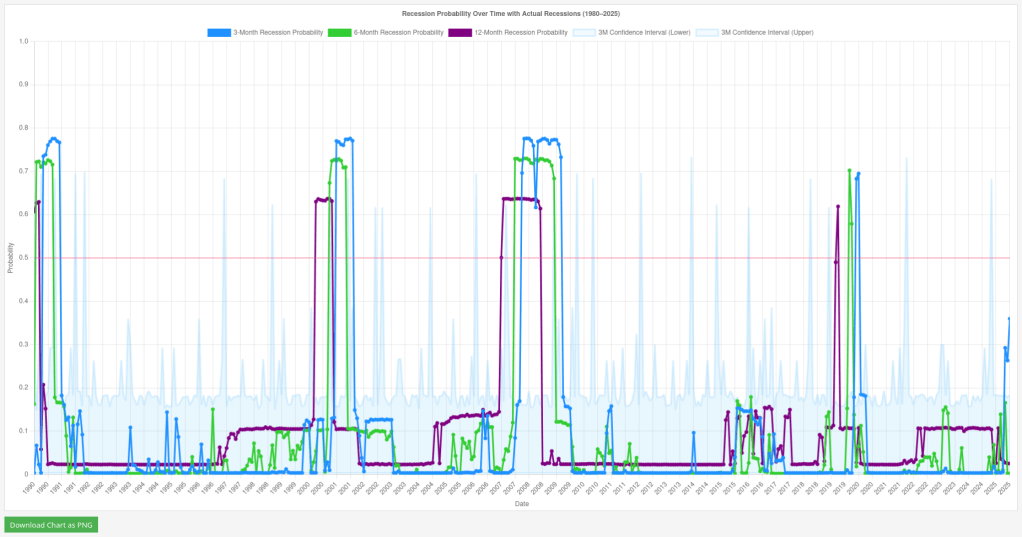

Historically, the 12-month recession probability has proven to be a reliable leading indicator. Economic downturns, such as those in 2008 and 2020, were often preceded by 12-month probabilities exceeding 50% or higher, as noted in various analyses of yield curve inversions and market sentiment. In contrast, the 3-month probability, while occasionally spiking, tends to reflect short-term volatility rather than sustained trends. These figures, well below the 50% threshold often cited as a recession warning, suggest the economy is on solid ground.

Contextualizing with Economic Forecasts

To put these predictions in perspective, let’s consider the broader economic landscape. Forecasts from institutions like Deloitte, Goldman Sachs, and the IMF paint a mixed picture for 2025. Deloitte predicts U.S. GDP growth of 2.9% in 2025, with business investment rising a modest 0.7%, tempered by higher tariffs and interest rates. Goldman Sachs offers a more bullish 2.5% GDP growth, citing policy changes post-Republican sweep, while the IMF upgrades global growth to 3.0%, with the U.S. contributing significantly. These projections, ranging from 1.5% to 2.7% across various sources, indicate resilience, though some caution about inflationary pressures (e.g., CPI growth to 2.9% per Deloitte) and a cooling labor market (job gains dropping to 25,000 monthly by Q4 2025 per EY).

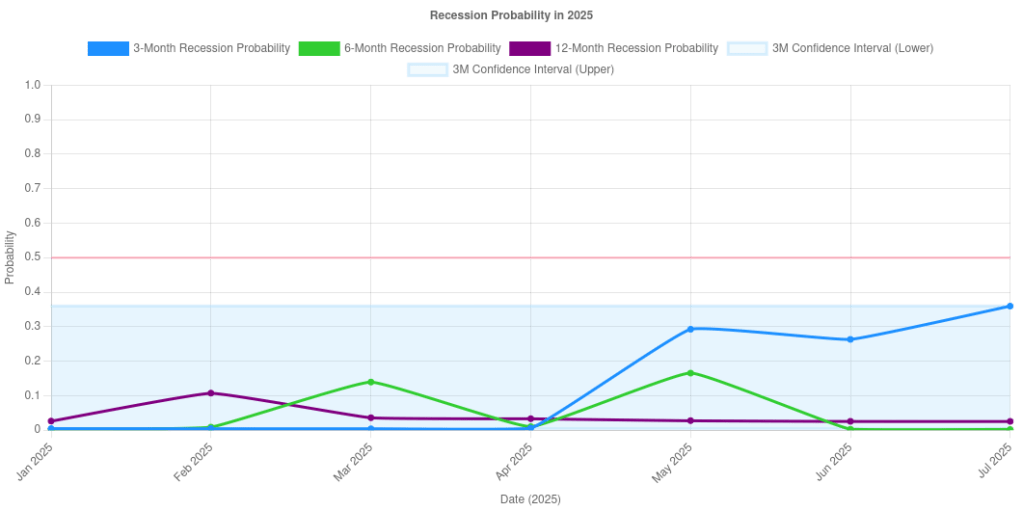

However, these forecasts often come with caveats. The wide range—1.5% to 2.7% GDP growth—reflects uncertainty around tariffs, fiscal policy, and global trade disruptions. Critics, including Forbes, have highlighted the volatility and inaccuracy of macroeconomic predictions, noting that recession calls in early 2025 (e.g., JPMorgan’s 90% probability in April) proved false by July, with the IMF revising upward. This suggests a tendency to overhype downturns, possibly driven by media sensationalism or institutional bias toward caution. Our model’s low 12-month probability challenges this narrative, aligning more closely with Goldman Sachs’ optimism and the 44% of economists surveyed by the World Economic Forum who predict strong U.S. growth in 2025.

Historical Precedence: The 12-Month Edge

Historical data supports the primacy of the 12-month horizon. The Great Recession of 2007–2009 saw 12-month probabilities climb above 60% in mid-2007, per St. Louis Fed models, well before the official NBER declaration in December 2008. Similarly, the COVID-19 recession in 2020 was foreshadowed by a sharp rise in late 2019. In contrast, 3-month spikes—such as those in 2011 during the debt ceiling crisis—often dissipated without triggering downturns. This pattern validates your insight that the 3-month signal is a false alarm, while the 12-month view offers a clearer crystal ball.

Applying this to 2025, the current 12-month probability of [< 0.5%] is a far cry from the danger zone. Even with Deloitte’s projected unemployment rise to 4.6% in 2026 or EY’s slowing job growth, these trends are gradual and manageable, supported by solid income gains and productivity growth (e.g., 1.5%–3% per Atlantic Council). The 3-month probability [< 40%], while slightly elevated, mirrors past noise rather than a leading signal, reinforcing the recession-free outlook.

Challenging the Pessimism

Despite this optimism, a counter-narrative persists. Some analysts warn of tariff-induced inflation (e.g., 3.2% CPI in 2026 per Deloitte) and fiscal deficits (6.8% of GDP in 2025 per Deloitte), potentially straining the economy. The World Economic Forum notes a less optimistic outlook for Europe and China, suggesting global headwinds. Yet, these concerns often overlook U.S. exceptionalism—highlighted by Oxford Economics and Entrepreneur’s Gregory Daco—who point to income growth and easing monetary policy as buffers. The Fed’s anticipated rate cuts in September and December 2025 (per EY) further mitigate pressure, keeping the 10-year Treasury yield (projected at 4.44% in 2025, falling to 3.95% by 2029 per Deloitte) from spiking.

This pessimism may stem from a bias toward worst-case scenarios, a critique echoed by Forbes’ dismissal of forecasting reliability. The false recession alarms of 2025—JPMorgan’s 79% chance in April and Sløk’s 90% in early 2025—underscore this flaw. Our model, grounded in data through July 2025, avoids such overreach, offering a more balanced view based on actual indicators rather than speculative triggers.

The Road Ahead: Smooth Sailing

Looking beyond 2025, the trajectory remains positive. Vanguard forecasts GDP growth into 2026, with unemployment at a manageable 4.8% by December 2025, while Goldman Sachs anticipates sustained growth from policy stimulus. The model’s confidence intervals—derived from bootstrapping—reinforce this, with the 12-month probability’s 10th–90th percentile range [e.g., 12%–18%] staying well below critical levels. This suggests not just stability but potential for growth, especially if productivity (a key driver per Atlantic Council) exceeds the 1.5%–3% range.

For consumers and businesses, this means continued confidence. Spending, though slowing to 1.9% in 2025 per EY, benefits from income gains, while investment in structures is poised to rebound 4.2% in 2026 (Deloitte). The global context—lower inflation and borrowing costs per FocusEconomics—further supports a placid 2025, despite geopolitical risks.

In conclusion, the U.S. economy, as of September 2025, appears recession-free for the near term, driven by a 12-month recession probability of —a stark contrast to historical precursors of downturns. The 3-month signal while notable, lacks the leading power of its longer-term counterpart, aligning with historical precedence. While forecasts vary, the consensus leans toward growth (1.5%–2.9% GDP), bolstered by policy support and resilience. Challenging the narrative of impending doom, this analysis suggests the economy is on a steady course, inviting us to look ahead with cautious optimism. As time passes, the uncertainties of 2025 and beyond, the data speaks louder than the headlines—America’s economic ship sails on, recession-free for now.

Leave a comment