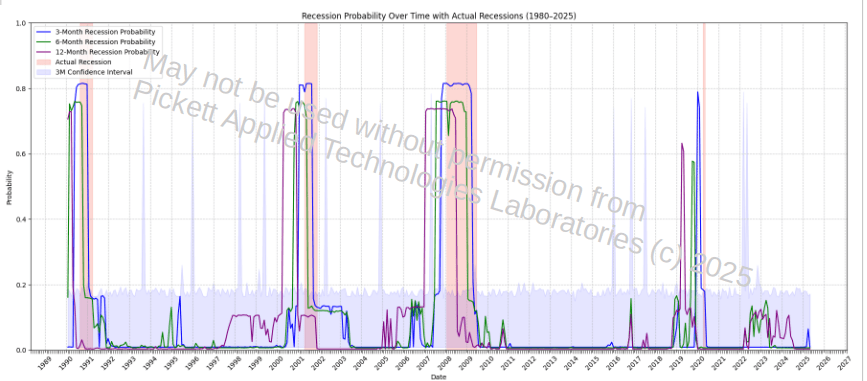

Our advanced machine learning model has delved into a wide array of economic indicators, and the findings are promising: there is less than a 2% chance of a recession occurring within the next year. This prediction is grounded in a thorough analysis of historical data combined with real-time economic trends, providing a comprehensive view of the current landscape.

Probability of Recession: A Closer Look

To break it down further, here’s how the probabilities of a recession unfold over different time horizons:

- 3-Month Horizon: The chance of a recession is less than 1% (specifically, 0.86%). This indicates a very stable economic environment in the short term.

- 6-Month Horizon: The likelihood remains low at less than 2% (0.66%). This reinforces the notion that the economy is on solid footing for the near future.

- 12-Month Horizon: While the probability rises to approximately 33% (0.33%), it still falls below the threshold that would categorize it as a high-risk scenario. This suggests that while uncertainties may exist, they are not indicative of an imminent downturn.

Economic Indicator Analysis: Strength in Numbers

Our model has meticulously analyzed key economic indicators, including GDP growth, unemployment rates, inflation, and interest rates, among others. The results paint a picture of a robust economy, showing no significant signs of a slowdown or recession.

Feature Importances: What Drives Our Predictions?

Understanding which indicators are most influential in our model’s predictions is crucial. Here’s a breakdown of the feature importances for each horizon:

The leading economic indicators for a 3-month horizon are:

- LEI (Leading Economic Index) with an importance of 0.518492

- GDP_Growth with an importance of 0.126274

- Yield_Spread with an importance of 0.072549

The leading economic indicators for a 6-month horizon are:

- LEI (Leading Economic Index) with an importance of 0.448674

- VIX (Volatility Index) with an importance of 0.106540

- GDP_Growth with an importance of 0.101251

The leading economic indicators for a 12-month horizon are:

- Unemployment with an importance of 0.387461

- CPI (Consumer Price Index) with an importance of 0.146628

- LEI (Leading Economic Index) with an importance of 0.133595

The Leading Economic Index (LEI) consistently emerges as a critical factor across all time horizons, underscoring its importance in forecasting economic trends. Additionally, indicators like unemployment and inflation rates play significant roles in shaping our predictions, reflecting the interconnected nature of these economic elements.

Conclusion: A Resilient Economy Ahead

In conclusion, our analysis of economic indicators and real-time trends leads us to a reassuring outlook: our machine learning model predicts that there is less than a 2% chance of a recession occurring within the next year. While some experts may express concerns about potential economic downturns, our findings suggest that the economy remains strong and resilient. As we move forward, it’s essential to stay informed and engaged with these trends, as they will undoubtedly shape our financial landscape in the months to come. The future looks bright, and we can approach it with confidence!

Leave a comment